How do I write off a bad debt?

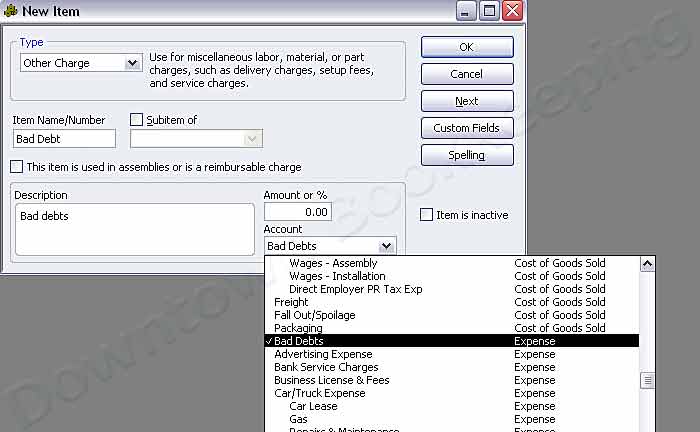

First, set up a New Item using Other Charge as the Type, Bad Debt as the Item Name, and linking it to the expense account for Bad Debts. (You may have to add this account to your Chart of Accounts.)

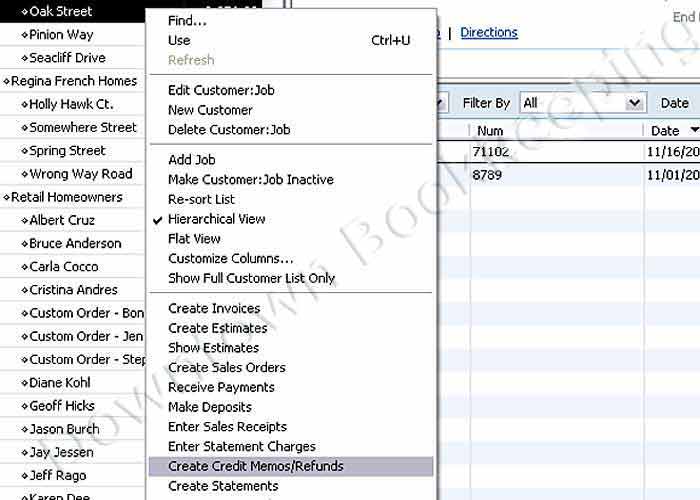

Right-click on the customer's name and select Create Credit/Memos/Refunds from the menu.

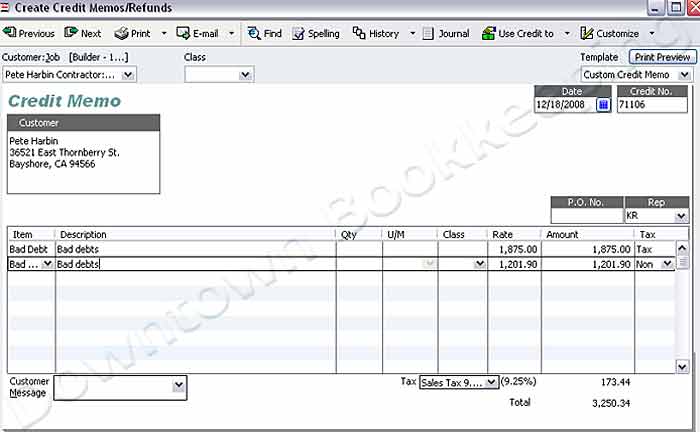

When creating this Credit Memo, it is important that the amounts you are writing off reflect the original Invoice, particularly with regard to Sales Tax. You will need to break out the Taxable amount on one line, and put any Non-Taxable amounts on the second line. QuickBooks will then calculate the Sales Tax so that this Credit amount is the same as the original invoice.

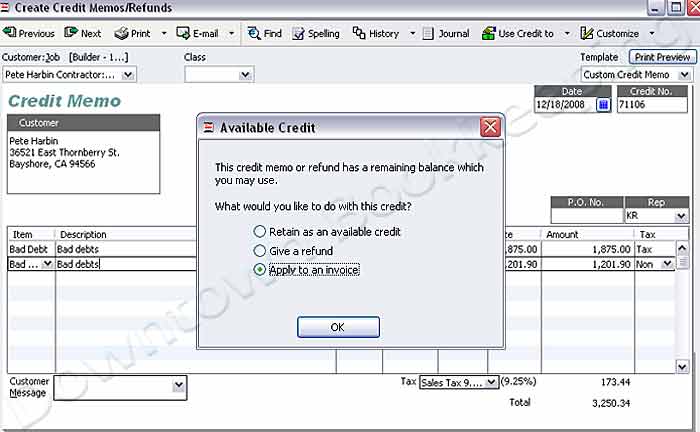

When asked how to use the remaining balance, choose Apply to an Invoice.

Then, apply this Credit Memo in the Apply Credits to Invoices window, and click Done, and the Invoice will now be marked PAID.